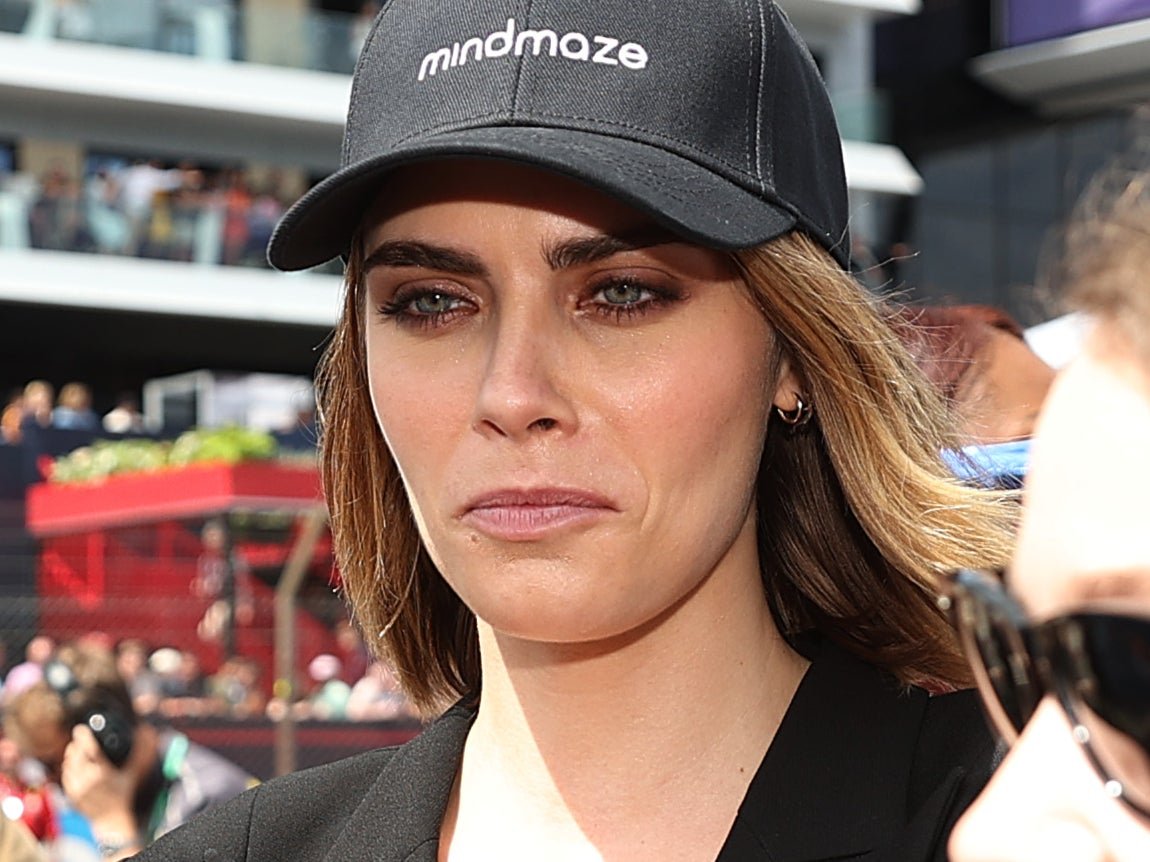

Brian Ruane

BNY Mellon

Brian Ruane, senior govt vice chairman, international head of clearance and collateral administration at BNY Mellon, lately met with Justin Lawson to debate the agency’s rising collateral enterprise, connecting to new swimming pools of collateral and the best way to combine the voice of the shopper

What are a few of the main traits you’re seeing in collateral administration?

Collateral administration is an integral a part of our shoppers’ funding, buying and selling and enterprise fashions — and shoppers proceed to look to us for flexibility, improved connectivity and knowledge analytics. With this in thoughts, companies are more and more contemplating consolidation and centralisation of funding actions. Shoppers wish to optimise their portfolio throughout a spread of metrics in a central funding mannequin, lowering funding prices through the use of the proper asset to assist the proper obligation in the proper authorized entity on the proper time.

Facilitating that is a part of our technique and consists of better integration and interoperability between settlement areas (CCPs, CSDs) which, in flip, is growing using collateral. To allow this, we proceed to search for elevated connectivity to different market infrastructure suppliers, expertise suppliers and shoppers by way of software programming interfaces (APIs), whereas persevering with to assist requirements resembling Swift safe monetary messages.

We additionally proceed to see demand for collateral mobility pushed by the necessity to meet regional obligations, minimise shortfalls and meet the Uncleared Margin Guidelines (UMR). To totally optimise and mobilise collateral, connectivity to different swimming pools of collateral and new markets is important. To realize this, we’re growing our connectivity to new markets, triparty brokers, central counterparties, central banks, fintechs and shoppers’ inner methods. For instance, we’ve got launched companies with Hong Kong Inventory and Bond Join, Euroclear Collateral Interface, Korea, Malaysia, and Indonesia, and we’ll roll out an answer in Taiwan later this yr.

As well as, market volatility has highlighted the significance of collateral administration for managing liquidity and mitigating counterparty danger. This volatility has affected most monetary establishments and, in consequence, a variety of collateralised services that use BNY Mellon’s platform have grown in recognition, together with the Federal Reserve’s Reverse Repo Program, the Standing Repo Facility, and the FICC’s Sponsored Normal Collateral Program.

The business can also be clearly benefiting from the work finished to adjust to all six phases of the Uncleared Margin Guidelines (UMR). For instance, an space of focus is the adoption of market requirements for margin messaging, reconciliation and growing automation, which is leading to improved settlement.

How is BNY Mellon guaranteeing that it stays forward of those traits?

We’re energetic within the collateral lifecycle and our scale, variety and resiliency allows shoppers to function in essentially the most optimum and environment friendly approach potential. We proceed to spend money on our core expertise infrastructure and consumer expertise with the purpose of enhancing the shopper expertise and simplifying doing enterprise on our platform. We’ll proceed to spend money on the platform and new applied sciences to make sure that our platform helps our shoppers’ wants and elevated demand for decision-making instruments.

What’s BNY Mellon’s collateral optimisation technique?

In immediately’s monetary markets, the demand for aggregation and environment friendly allocation of collateral is rising and, in response, we’re investing in capabilities that give shoppers a complete view of their sources and makes use of of collateral, in addition to offering optimisation throughout asset varieties, transaction varieties and collateral venues. For instance, by leveraging the power of our sturdy collateral optimisation engine, eligibility screening and directed allocation options, shoppers can extra effectively allocate collateral throughout BNY Mellon’s US$6 trillion platform in a brief time frame.

Know-how is a key a part of the success of those options. Our optimiser makes use of a number of patented algorithms, client-defined stock knowledge, customised value fashions and safety reference knowledge to scale back funding prices related to Liquidity Protection Ratio, Web Steady Funding Ratio, Danger-Weighted Belongings, and extra. As well as, we acknowledge the worth of collaboration – and, in consequence, have established strategic relationships with Pirum Techniques and Baton Techniques and frequently interact with shoppers to exhibit the worth our experience and options can unlock.

A characteristic that every one our options have in widespread is that they don’t signify a one-size-fits-all method. Shoppers can select to make use of the total suite of optimisation companies or particular modules along side their very own optimisation instruments. On this approach, by way of our strategic investments and collaborations, we’re creating key constructing blocks to realize a very international and really tailor-made optimisation for our shoppers.

What are your shoppers’ views on the way forward for collateral administration?

It’s an thrilling time to be within the collateral house. We’re consistently listening to our shoppers – and it’s clear from these conversations that resiliency, innovation, mobility and connectivity are a few of the necessary pillars for the long run.

Particularly, we hear – and in addition consider – that the rising applied sciences which are remodeling the world round us, resembling synthetic intelligence, tokenisation, and cloud computing, are well-placed to enhance collateral administration. Because of this, we proceed to discover methods to combine them into our platform to supply enhanced resiliency and worth to our shoppers. Alongside this, we’re additionally investing in our folks, as evidenced by our new class of interns, the most important in our agency’s historical past. This mix of recent engineering expertise and applied sciences will play a vital function in bringing markets and platforms collectively such that our shoppers can derive better efficiencies and higher handle their scarce sources.

We additionally consider that ongoing technological innovation will make optimisation simpler in the long term. For instance, we’re within the early levels of creating companies to assist tokenised US Treasuries from a clearance, settlement and collateral administration perspective throughout areas and time zones. We method this by creating the long run market infrastructure expertise platforms that can ship digital asset custody and tokenisation-as-a-service.

What can your shoppers sit up for from BNY Mellon within the close to time period?

Given our market place, shoppers additionally speak to us about how we are able to leverage our knowledge to supply them with better efficiencies. One instance of that is our funding in our front-office analytics portal, which can supply premium companies based mostly on synthetic intelligence with built-in options geared toward enhancing our shoppers’ revenue margins. One new product we’re significantly excited by is our Treasury-Fails Indicator & Auto-Borrow Service, a machine-learning based mostly predictive analytics service that forecasts anticipated fails and cancels hours earlier than they happen. Sellers can then borrow Fed-eligible securities by way of a push-button resolution, mitigating fails to scale back fail costs and generate investable money. Mitigating fails has a fabric return on funding that isn’t broadly understood available in the market.

One other characteristic of the portal is our Repo Unfold Indicator, an AI analytics service that forecasts bilateral treasury repo charges over the public sale cycle for on-the-run treasury securities to assist shoppers scale back their value of funding and improve their lending revenues. We’re excited to work with our shoppers utilizing a consultative method and in-depth evaluation as they appear to optimise their international portfolio of belongings throughout areas, authorized entities and repair suppliers.